Cataract surgery is one of the most common and effective procedures to restore clear vision and improve the quality of your life.

But as simple as it might seem, navigating the financial aspects of this procedure—especially with Medicare—can be tricky. Armed with the right knowledge, you can ensure you’re not leaving any benefits on the table while keeping your out-of-pocket expenses as low as possible.

In this guide we will break down everything you need to know about how Medicare works for cataract surgery, potential costs, coverage exclusions, and tips to maximize your benefits.

Does Medicare cover cataract surgery? We’ll answer this and more.

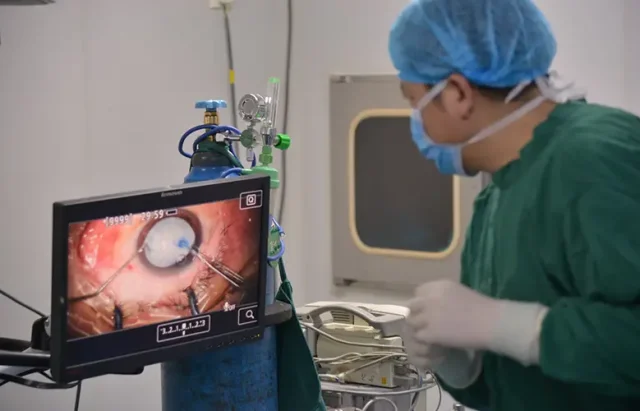

The Importance of Cataract Surgery

Cataracts are more than just a minor inconvenience—they can have a significant impact on your daily life routines.

As the natural lens of your eye becomes clouded, almost like a curtain being pulled over your eyes, your vision deteriorates, making it difficult to read, drive, or even recognize faces.

Left untreated, cataracts can lead to legal blindness, drastically affecting independence and quality of your life.

They affect nearly half of Americans by the age of 80, with around 3.7 million cataract surgeries performed annually.

Cataract surgery isn’t just about restoring sight; it’s about regaining your freedom and reducing the risks associated with poor vision, such as falls and accidents.

Studies show that individuals who undergo cataract surgery experience great improvement in their mental health, physical safety, and even longevity.

While the procedure is straightforward, its costs can vary widely. Thankfully, Medicare offers significant coverage to make cataract surgery accessible, but understanding the fine print is key.

How Medicare Covers Cataract Surgery

Medicare has its role in covering cataract surgery, particularly if you fall in the group of seniors or people with disabilities.

Here’s a breakdown of how each part of Medicare contributes:

1. Medicare Part B: Outpatient Services

In most cases, cataract surgery is an outpatient procedure (medical treatment or surgery that doesn’t require an overnight stay in a hospital), it’s primarily covered under Medicare Part B.

This includes:

- Pre-surgery exams to determine the severity of the cataract

- The surgical procedure to remove the cataract

- Implantation of a standard monofocal intraocular lens (IOL)

- Postoperative care, including follow-up visits

- One pair of prescription eyeglasses or contact lenses after the procedure.

Medicare Part B covers 80% of the approved costs after you meet your annual deductible ($240 in 2024). The remaining 20% falls on you unless you have supplemental insurance.

2. Medicare Part A: Inpatient Care

In rare cases, complications during surgery may result in an overnight hospital stay.

In such situations, Medicare Part A covers hospital-related expenses. However, you’ll need to meet the Part A deductible ($1,632 in 2024) before coverage kicks in.

3. Medicare Advantage (Part C): All-in-One Plans

Medicare Advantage plans combine the benefits of Parts A and B, often including additional perks like lower out-of-pocket costs, reduced copayments, or coverage for premium lenses.

These plans vary by provider, so review your specific policy to understand how it would cover your cataract surgery.

4. Medicare Part D: Prescription Drugs

Post-surgery recovery often involves medications like anti-inflammatory eye drops.

Medicare Part D will help cover the cost of these prescriptions, but only if the medication is listed in your plan’s formulary.

Maximizing Medicare Benefits for Cataract Surgery

To make sure you don’t spend any unnecessary money from your own pocket, try the following:

1. Examine Your Coverage

Before going into the surgery, examine your plan to fully understand what Medicare will cover in your case.

If you have trouble understanding the nuances of your Medicare plan, you can always consult your Medicare handbook or call your provider for clarification.

2. Choose Medicare-Approved Providers

Opt for doctors and surgical centers that accept Medicare assignments, so you don’t get billed beyond Medicare’s approved amount.

3. Time Your Procedure Wisely

If you’ve already met your Part B deductible for the year, scheduling your surgery before the year ends can save you money.

On the flip side, if your deductible is going to reset soon, consider delaying the procedure, if possible, until after the reset to maximize your coverage.

4. Explore Medicare Advantage Plans

If you have a Medicare Advantage plan, check for additional benefits like lower copayments or partial coverage for premium lenses.

Some plans also offer coverage for transportation to and from medical appointments.

5. Invest in Medigap Insurance

Medicare supplement plans, or Medigap, help cover the 20% coinsurance left by Original Medicare.

While they don’t cover premium lenses or elective services, they can significantly reduce your out-of-pocket costs.

Common Exclusions and Out-of-Pocket Costs

Even with Medicare, there can be exclusions and potential out-of-pocket expenses, including:

- Premium lenses: Medicare covers only standard monofocal lenses. Advanced options like multifocal or toric lenses are not covered.

- Laser-assisted surgery: Medicare covers the cost of surgery regardless of whether a laser or manual method is used, but laser surgery often comes with additional fees, such as the surgeon’s extra charges for using advanced technology.

- Medications: While Medicare Part D covers some prescriptions, not all medications related to surgery may be fully reimbursed.

Breaking Down the Costs of Cataract Surgery

The cost of cataract surgery with Medicare depends on several factors, such as the type of procedure, the facility, and the surgeon’s fees.

In general, here’s what you might expect:

- Facility fee: $1,500–$2,500

- Surgeon’s fee: $500–$1,000

- Total estimated cost (Per Eye): $1,906–$2,943

Questions to Ask Your Provider

To maximize your benefits and avoid unexpected costs, ask your provider the following questions:

- Does the facility accept Medicare?

- What is the exact Medicare billing code for the procedure?

- Will the surgery require an inpatient hospital stay?

- Are advanced lenses or laser techniques recommended? If so, what are the additional costs?

- Which postoperative medications will be prescribed?

Medigap and Additional Financial Assistance

If out-of-pocket costs are still a concern, consider these options:

- Medigap plans: As mentioned earlier, these plans help cover the costs Medicare doesn’t pay.

- State assistance programs: Many states offer financial assistance for low-income Medicare beneficiaries.

- Nonprofit organizations: Groups like Mission Cataract USA provide free cataract surgeries for individuals who don’t have the means to pay for them by themselves.

Conclusion

Cataract surgery is a critical procedure that Medicare can make significantly more affordable.

However, navigating the various parts of Medicare and understanding coverage exclusions is essential to avoid unpleasant surprises.

By taking proactive steps—like choosing Medicare-approved providers, exploring supplemental insurance options, and timing your surgery strategically—you can maximize your benefits and minimize costs.

Clear vision is within reach, and with the right knowledge, you can achieve it without breaking the bank. Don’t let cataracts cloud your future—use Medicare to its fullest and take the first step toward brighter days.