Traveling has become synonymous with exploration, adventure, and embracing new experiences. Whether you’re wandering through ancient cities, lounging on pristine beaches, or hiking in remote landscapes, one thing remains constant: the need for convenient and secure payment methods. In this digital age, mobile transactions have emerged as a game-changer, offering traveller’s unparalleled payment freedom. In this article, we’ll explore the evolving landscape of mobile payments in the realm of travel and how it’s transforming the way we navigate and experience the world.

The Rise of Mobile Transactions

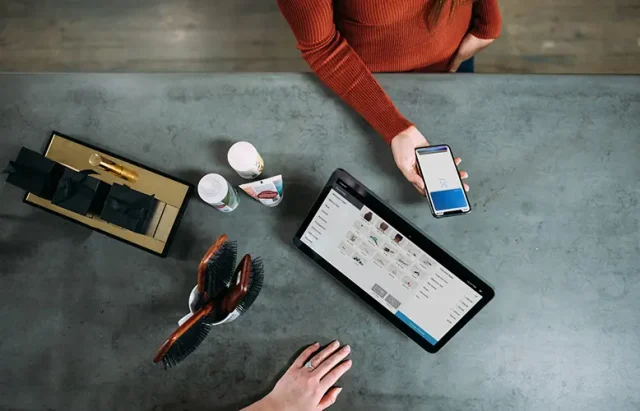

The rise of mobile transactions has been nothing short of revolutionary. Gone are the days when travellers had to carry bundles of cash, traveller’s checks, or even multiple credit cards. Today, smartphones have become indispensable travel companions, serving as virtual wallets that empower us to make payments, book accommodations, purchase tickets, and even hail rides with just a few taps.

Travel Apps and Beyond

Mobile transactions have also revolutionized the way travellers interact with travel-related apps and services. Booking flights, accommodations, and activities through mobile apps is not only convenient but often comes with exclusive discounts and offers. These apps frequently integrate with mobile payment options, streamlining the booking process and allowing for easy, one-click payments.

Additionally, many ride-sharing services and public transportation systems around the world have embraced mobile payments. This means you can navigate cities with ease, whether it’s catching a taxi in Bangkok, hopping on a subway in London, or renting a bike in Amsterdam, all with your smartphone as your payment method.

Travelers can now enjoy the thrill of playing casino games online even while on the move. Online casinos have introduced seamlessly convenient payment options like the pay by mobile casino feature, allowing players to make deposits and enjoy their favourite games with unprecedented ease. This innovative payment method not only ensures security and efficiency but also eliminates the need to carry cash or credit cards, making it the perfect companion for those exploring new destinations. Whether you’re waiting at an airport, relaxing on a beach, or taking a break in a bustling city, online casino with mobile payment options offers a seamless and immersive gaming experience that fits right in with your travel plans.

Convenience at Your Fingertips

Imagine arriving in a foreign city and seamlessly navigating your way from the airport to your hotel. With mobile payment apps like Apple Pay, Google Pay, and various banking apps, this is now a reality. Travelers can link their credit or debit cards to these apps, allowing for contactless payments at an array of establishments, from hotels and restaurants to local markets and transportation services.

The convenience doesn’t stop there. Mobile banking apps enable travellers to check their account balances, monitor transactions, and transfer funds, all while on the move. This level of financial control was unimaginable just a few years ago and is a testament to the power of mobile transactions.

Security and Peace of Mind

Security is a paramount concern for travellers, and mobile transactions are designed with this in mind. These payment methods employ robust encryption techniques and authentication processes, making it exceedingly difficult for unauthorized individuals to access your financial information. Additionally, many mobile payment apps offer features like remote card locking and biometric authentication (such as fingerprint or facial recognition), adding an extra layer of security.

Moreover, if you lose your physical wallet, you risk losing not only your money but also important identification documents. Mobile payments mitigate this risk by allowing you to store digital copies of your identification and travel documents securely on your device.

Eliminating Currency Hassles

One of the primary benefits of mobile transactions while traveling is the ability to eliminate currency hassles. When exploring countries with different currencies, mobile payment apps automatically handle currency conversion at competitive exchange rates. This means you can pay for your morning coffee in Tokyo, grab lunch in Paris, and shop for souvenirs in New York City, all without worrying about exchanging physical cash or incurring excessive currency conversion fees.

Furthermore, mobile transactions often offer favourable exchange rates compared to traditional currency exchange services. This can result in significant cost savings over the course of your travels.

The Future of Travel Payments

As technology continues to advance, the future of travel payments is poised to become even more seamless and innovative. We can expect to see further integration of mobile payments with augmented reality, voice recognition, and other cutting-edge technologies. Travelers may soon be able to make payments simply by speaking a command or pointing their phone at a QR code.

Furthermore, blockchain technology and cryptocurrencies are gaining traction in the travel industry. Some travel agencies and airlines already accept Bitcoin and other cryptocurrencies, offering travellers an alternative way to pay for their adventures. While these methods are still evolving, they represent exciting possibilities for the future of travel payments.

In conclusion, mobile transactions have ushered in a new era of payment freedom for travellers. From enhanced convenience and security to simplified currency management, mobile payments have become an integral part of the modern travel experience. As technology continues to evolve, the synergy between travel and mobile transactions is likely to bring even more innovations and conveniences, making our journeys more enjoyable and stress-free than ever before. So, the next time you embark on an adventure, don’t forget to bring along your smartphone—it’s not just your camera; it’s your passport to payment freedom on the road.