In the case of a financial emergency, Money Market Accounts (MMAs) are a popular choice for people looking to earn a higher interest rate than reading the review and considering a traditional savings account. However, as with any financial decision, it’s important to consider the safety of the investment.

However, questions like “Is it safe to place money in MMA?” It’s a valid question, given the volatility of the economy and the many financial scams and scandals that have made headlines in recent years.

In this article, I’ll provide an in-depth answer to this question, exploring the characteristics of MMA, its associated risks, and strategies for minimizing those risks.

Money Market Account. What Is That, and Why Is It Liked?

This is one type of investment account that often carries a higher interest rate than traditional deposit accounts. This makes it a popular alternative for someone who wants to conserve funds but doesn’t want to risk losing them. MMA is generally considered to be a safe place to deposit money.

MMA is also typically FDIC-insured, which means that if the bank or credit union were to fail, your money would be insured up to the maximum amount allowed by the FDIC (currently $250,000 per depositor, per insured bank or credit union).

There are many varied MMAs available, each with its own characteristics and perks. A few examples of MMAs include:

Ally Bank MMA

Ally Bank’s MMA offers a competitive interest rate and no monthly maintenance fees. It as well allows for easy access to funds through checks, online transfers, and an ATM card.

Capital One 360 MMA

This account offers a tiered interest rate based on your balance, with higher balances earning higher rates. There are no fees or minimum balance requirements, and account holders can access their funds through checks, online transfers, and an ATM card.

Sallie Mae MMA

Sallie Mae’s MMA offers a competitive interest rate and no monthly maintenance fees. It allows easy access to funds through checks, online transfers, and an ATM card.

TD Bank Premier MMA

TD Bank’s MMA offers a tiered interest rate based on your balance, with higher balances earning higher rates. There are no monthly maintenance fees, and account holders have to access their funds through checks, online transfers, and an ATM card.

What Are the Risks Associated with MMA?

One of the big risks is the failure of the bank or credit union in which MMA is held. Although the FDIC or NCUA covers MMA, this protection only covers a certain amount (currently $250,000 per insured bank depositor).

Therefore, if your MMA has more than $250,000 in one bank, extra uninsured funds may be lost in the event of its bankruptcy. Monthly account maintenance fees, low balances, or frequent transactions must cost you a lot of money over time.

For instance, if you invest $2,000 in an MMA, earning 3.00% per year, your annual return would be $60.90. But don’t forget about the monthly maintenance fee for your account, which is $6 per month, you will lose $11.10 per year.

If you plan to maintain a higher balance, the interest earned may outweigh the potential fees, leaving you with a positive yearly income. Another risk associated with MMA is interest rate risk. Because MMA interest rates are usually pegged to short-term interest rates, they can fluctuate in the market.

This means that the rate on your MMA can fluctuate over time, potentially reducing your return on investment. In addition, MMA may have minimum balance requirements and other fees that can eat into your earnings.

Strategies for Minimizing Risk in Money Market Accounts

Numerous strategies can help everybody keep all the risks associated with MMA to a minimum. The first approach is to distribute all your reserves to several banks or credit unions so as not to send the coverage limit to one institution.

This usually takes a lot longer than just leaving all your funds in one bank, but it can help protect your savings in the event of a bank failure.

Another strategy is to choose an MMA that invests in high-quality, low-risk securities such as government bonds. These investments are generally considered safer than riskier investments such as corporate bonds, which may offer higher returns but furthermore carry more risk.

Alternatives to MMA

If you’re looking for alternatives to MMAs, there are several options available. Here are a few alternatives to consider:

- High-yield investment accounts offer similar advantages to MMAs, including higher interest rates plus low risk, but may have fewer restrictions on transactions and fees. They may also have different account requirements, such as minimum balances or deposit limits.

- Certificates of Deposit (CDs) are time-based deposits generally offering higher interest rates than MMAs. They are also FDIC or NCUA insured but require a commitment to keeping your funds in the account for a specific duration, which can range from numerous months to multiple years.

- Corporate bonds: Corporate bonds offer higher returns than government bonds but carry a higher risk of default. Companies issue them to raise capital and offer a fixed interest rate over a set period.

- Money market funds: Money market funds are mutual funds that invest in short-term debt securities, such as Treasury bills and commercial paper. They offer higher returns than MMAs but are not FDIC or NCUA insured and carry a slightly higher risk.

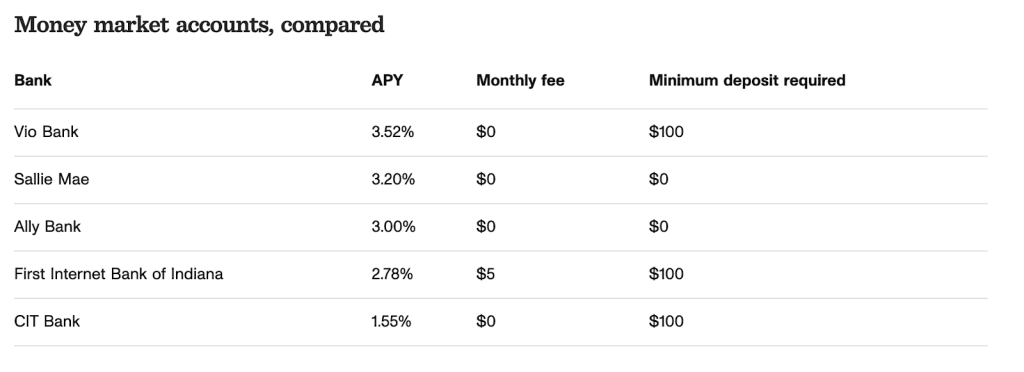

Choose the best Money Market Account for your finances. You can make a choice based on the Best MMA table here.

So, if you have a small sum under $100, only two variants suit you. But if you have $100 and more, all of the Banks can be a good option. In this case, it is normal to compare APY and the total reputation of banks.

The Bottom Line

In conclusion, MMAs can be a safe and viable investment choice for those looking to receive a higher interest rate than a traditional savings account. However, as with any investment, there are risks associated with MMAs that need to be carefully considered. Overall, Money Market accounts can be a safe place and viable investment to deposit your money.

However, as with any investment, there are risks associated with MMAs that need to be carefully considered. It’s important to consider the terms and conditions of any account carefully you’re thinking about and to choose a reputable financial institution.